The car title loan inspection process involves detailed vehicle and ownership evaluations by professionals. Lenders require clear registration for proof of ownership, crucial for quick approval while securing the car as collateral. This multi-step process includes document verification, physical assessment, and authentication to ensure a secure and reliable car title loan.

Car title loans offer a quick financial solution, but understanding the inspection process is key. Lenders require thorough checks to verify vehicle ownership and ensure collateral integrity. This article guides you through the car title loan inspection process, highlighting essential requirements and providing a step-by-step breakdown. Learn how to gather the necessary proof of ownership documents to navigate this financial option smoothly.

- Understanding Car Title Loan Inspection Requirements

- Verifying Vehicle Ownership: Essential Proof

- The Process: Step-by-Step Guide to Inspection

Understanding Car Title Loan Inspection Requirements

When applying for a car title loan, understanding the inspection process is key to ensuring a smooth transaction. The car title loan inspection involves a thorough evaluation of your vehicle’s condition and ownership status. Lenders will require proof of vehicle ownership, typically through a clear and valid registration document. This step is crucial as it confirms that you have the legal right to pledge your vehicle as collateral for the loan.

During the inspection process, a professional appraiser will assess various aspects of your car, including its make, model, year, mileage, overall condition, and market value. They’ll also verify that the vehicle matches the information provided in your application. Keeping your vehicle well-maintained and up-to-date with service records can expedite this process. Remember, a successful inspection is essential for securing quick approval and keeping your vehicle as collateral while accessing much-needed funds.

Verifying Vehicle Ownership: Essential Proof

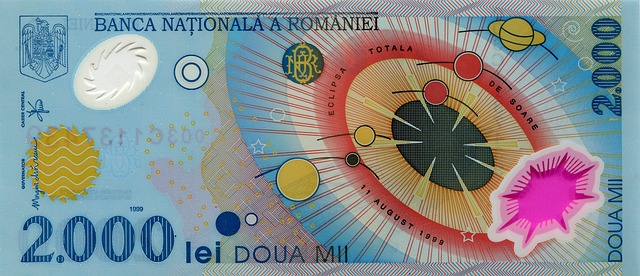

When undergoing a car title loan inspection process, verifying vehicle ownership is a crucial step. This involves presenting comprehensive proof that demonstrates both legal ownership and control over the vehicle in question. It’s essential to have all necessary documentation ready, as it ensures a smooth and efficient evaluation of your asset.

During this stage, lenders will scrutinize key elements such as the vehicle’s registration, insurance records, and, most importantly, the car title itself. This proof of ownership is vital, especially when considering emergency funds or exploring options for emergency funding through secured loans. A clear title, free from any liens or outstanding loans, significantly enhances your chances of approval and often results in more favorable terms during the loan inspection process.

The Process: Step-by-Step Guide to Inspection

The car title loan inspection process involves a thorough evaluation of both your vehicle and its ownership documents. It’s a crucial step in securing a secured loan using your vehicle as collateral. Here’s a step-by-step guide to navigating this process smoothly:

1. Gather Required Documents: Before the inspector arrives, prepare all necessary paperwork, including your car title, registration, insurance proof, and identification documents like driver’s license or passport. These documents verify both your identity and ownership of the vehicle.

2. Schedule an Inspection: Many lenders will send a qualified inspector to assess your vehicle at a time convenient for you. During this visit, the inspector will physically inspect your car, checking its condition, mileage, and overall market value. They’ll also verify that all documents are genuine and accurate.

3. Vehicle Condition Assessment: The inspector will evaluate various aspects of your car, including its exterior and interior, engine, tires, and overall mechanical state. They’ll check for any signs of damage, wear, or necessary repairs to determine the vehicle’s current equity. This step is vital in calculating how much you can borrow against your vehicle’s value in a secured loan like a car title loan.

4. Documentation Verification: Along with physical inspection, the inspector will cross-check all provided documents for accuracy and authenticity. They’ll ensure that the car title is free from any liens or encumbrances other than the existing loan (if applicable). This process safeguards both you and the lender, ensuring that your vehicle’s ownership is legitimate and clear.

When applying for a car title loan, undergoing the inspection process is a crucial step. By understanding the requirements and following the step-by-step guide outlined in this article, you can ensure a smooth and efficient transaction. Verifying vehicle ownership through proper documentation is an essential part of this process, ensuring both security and legitimacy for all parties involved in the car title loan inspection process.