The car title loan inspection process assesses vehicle condition, including cosmetic damage, age, make, model, and market value compared to regional standards. Lenders prioritize vehicle safety, functionality, and residual worth over minor aesthetic issues, offering same-day funding and flexible payments while ensuring collateralized vehicles remain drivable for borrowers in need of quick financial support.

“In the world of car title loans, minor cosmetic damage doesn’t always mean a denied application. This article explores the intricate balance between assessing vehicle condition and securing approval. We delve into the critical role of inspection in the car title loan process, demystifying common misconceptions about minor damage. Understanding how assessors evaluate cosmetic issues can empower borrowers, ensuring a smoother path to financial support. Learn how a thorough yet fair inspection process contributes to an accurate assessment, catering to both lenders and prospective borrowers.”

- Understanding Cosmetic Damage Assessment

- The Role of Vehicle Inspection in Title Loan Approval

- Common Misconceptions About Minor Damage and Loans

Understanding Cosmetic Damage Assessment

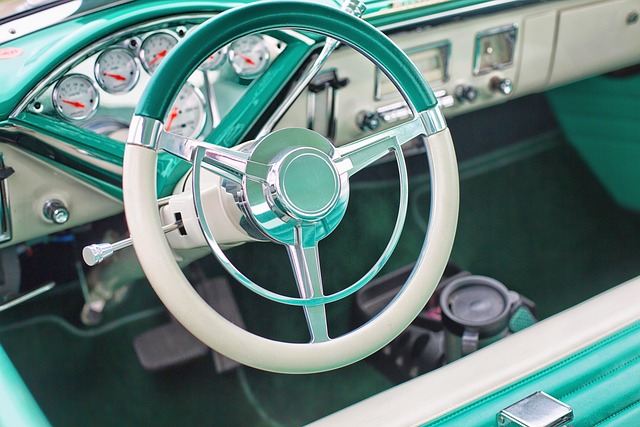

When considering a car title loan, understanding the assessment process is key, especially when it comes to cosmetic damage. Lenders will carefully inspect your vehicle during the appraisal stage to determine its overall value. This includes evaluating any minor scratches, dents, or dings on the exterior and interior of your car. While these issues may seem insignificant, they can significantly impact a loan approval decision, as lenders aim to mitigate risk.

The Car title loan inspection process involves a thorough examination of various components, including the vehicle’s age, make, model, and condition. Minor cosmetic damage is typically addressed on a case-by-case basis, with lenders considering factors like the extent of the damage, its effect on safety or performance, and the overall market value of similar vehicles in regions like Dallas Title Loans or San Antonio Loans. Keeping your vehicle well-maintained and addressing any cosmetic concerns before applying for an emergency fund through a title loan can enhance your chances of approval.

The Role of Vehicle Inspection in Title Loan Approval

When applying for a car title loan, one of the critical steps in the approval process is the vehicle inspection. This thorough evaluation goes beyond simply looking at the exterior and interior condition of your car. It involves checking key components like the engine, transmission, brakes, and electrical systems to ensure they are in good working order. The inspection process plays a pivotal role in assessing the overall value and safety of the vehicle, which is essential for determining the loan amount you can qualify for.

The car title loan inspection process is designed to offer financial assistance to borrowers while ensuring both parties’ protection. Lenders want to provide same-day funding and flexible payments, but they must also mitigate risk by confirming that the collateral—your vehicle—is in a drivable condition. This careful balance allows individuals in need of quick financial support to access much-needed funds while maintaining the security of their asset.

Common Misconceptions About Minor Damage and Loans

Many people hold onto misconceptions when it comes to applying for car title loans with minor cosmetic damage. It’s often believed that even small dents or scratches could automatically disqualify an applicant, leading to frustration and missed opportunities. However, the reality is quite different during the car title loan inspection process. Lenders are primarily concerned with the overall value and residual worth of your vehicle, not perfection. They understand that accidents happen, and a few cosmetic issues won’t significantly impact the car’s functionality or resale value.

The flexibility of Car Title Loans allows borrowers to keep their vehicles while repaying the loan in manageable, flexible payments. This is particularly beneficial for those with unexpected expenses who need quick access to cash without sacrificing their assets. Unlike traditional loans that might require strict credit checks and lengthy application processes, car title loans offer a streamlined approach, making them an attractive option for many.

While minor cosmetic damage may seem like a simple fix, it can significantly impact the car title loan approval process. Understanding how vehicle inspection plays a crucial role in assessing these damages is essential. By dispelling common misconceptions, borrowers can navigate the car title loan inspection process with confidence, ensuring a smoother journey towards securing the funds they need without oversimplifying the importance of transparency and condition disclosure.